Ask and You Shall Receive…Video Game Market Research

Ask and you shall receive? What does that even mean? Before writing this off as a religious overture, hear me out here. A video game marketing professional, I find this critical. As in critically important for anyone in video game publishing. And even more important for anyone making video games.

Allow me to explain. Like any quantitative minded marketer, I think of the world as a funnel. As in One. Big. Funnel. Borrowing something that my team had created some couple years ago, check out the following.

More aptly, if you are in the business of making video games, you are already familiar with the game development framework or process. No matter how you slice and dice it, it roughly breaks down into:

I. Concept –> II. Pre-Production –> III. Production –> IV. Launch –> V. Live Service/Maintenance

Needless to say, a marketer isn’t necessarily a ninja in agile product development. Nor a 6-degree black belt in financial planning and forecasting However, allow me to illustrate. HOW CAN video game market research benefit a video game? Literally in each of Concept, Pre-Production, Production, and Live Service/Maintenance stage? And I will use a random video game example to make my point. Disclaimer: I deliberately selected games that I did NOT work on. Translation: no Nondisclosure Agreements signed OR violated here. But if you are in the business of making video games, keep reading.

But regardless, I hope you walk away with a solid understanding of how video game market research helps increase your ODDS of the commercial success of YOUR game.

Let us begin.

I. Video Game Market Research: Concept Validation

Before writing a single line of code, the developer needs to assess market opportunity and the Total Addressable Market. To get at the answer, we may get creative. Assume the developer is thinking about building a card battle game with strategy and RPG.

-

Branded Intellectual Property (IP) vs Original IP

What’s on the table? The developer wants to base the card battle game on a known IP. It may be considering the Power Rangers, Transformers, or Star Wars. Let us assume the royalty requirements are 10% of Net Sales (no annual minimum), 20% of Net Sales (annual minimum $500 thousand), and 30% of Net Sales (annual minimum $10 million) respectively.

First and foremost, let us start by defining the Gameplay and Visual Targets. Say the producer decided the nearest competitors are: Yu-Gi-Oh! Duel Links, South Park Phone Destroyer, Elder Scrolls: Legends, Animation Throwdown, and Hearthstone. Of course the feedback can come from anyone from a range of video game careers. The key is to identify THE visual targets and the so-killed “Beat” and “Kill” list…

0. Video Game Market Research: Awareness and Affinity

To test a Game Concept, you can use a standard SaaS survey tool like SurveyMonkey or Peanut Labs Samplify. You know what the experts say. The market research is only as good as the sampling of the target gamers. To let in the right players and ONLY the right players, we can create a SCREENER upfront.

The beauty? The data you gather can be used a lot of different ways. To inform features, ad copy, social post creatives, just to name a few.

Good video game market research starts with a SUPER Clear picture of who the target players are.

Consumer insights can be gathered a lot of different ways. But how do you do that for a game that has not yet been defined, and there is no minimal viable product for them to see, touch, and test?

Answer: A simple survey of the competitor’s players. To screen IN only players who play the above games, we can include an upfront question:

In the past 30 days, which of the following mobile games did you play?

- Yu0Gi-Oh! Duel Links: SCREEN IN

- South Park Phone Destroyer: SCREEN IN

- Elder Scrolls: Legends,: SCREEN IN

- Animation Throwdown,: SCREEN IN

- Hearthstone: SCREEN IN

- NO to all of the above: SCREEN OUT

- Words with Friends 2: SCREEN OUT

When programmed in SurveyMonkey, the Screener questions look like the below:

To test awareness and favorability for an IP, the video game market research survey can simply ask

Once the video game market research sample of target players have been recruited, now what? Simple. Ask away. If you want to know whether respondent finds the concept art favorable. Or if he or she intends to Download and Try the game.

For example, to find out his or her Download and Play Intent, ask:

Based on just the game screenshot, how likely are you to DOWNLOAD and PLAY the game on your Android Phone?

(A) Very Unlikely

(B) Somewhat Unlikely

(C) Somewhat Likely

(D) Very Likely

When you have collected the responses from ALL the respondents, you can analyze the Favorability and Play Intent results for ALL respondents (as a whole) or a subset (such as just Players of Hearthstone)

II. PRE-PRODUCTION. AD CREATIVE TESTING

-

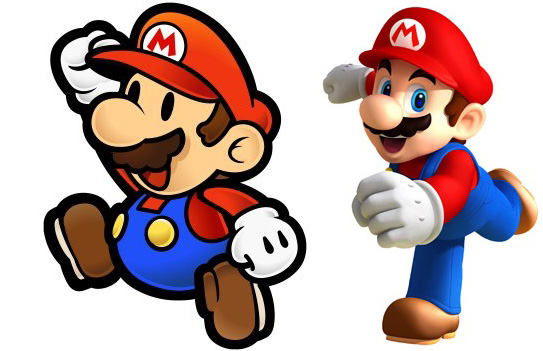

2D vs 3D Art

Typically during Concept Testing, the actual art style may still be TBD. What if the game team wants to test the target player’ likelihood to click on an Ad based on either 2D or 3D art? Easy. Create an A and a B version of the ad creative. Ask the survey respondents to select the ONE that he/she is (A) more likely to CLICK on and (B) more likely to DOWNLOAD AND PLAY.

2. Video Game Pricing

During Pre-Production, you can simply ask your competitor’s players. Question ow much they are able or willing to pay? For a premium-priced 1-time download game, or even for individual items up for sale, that you consider.

III. Production. REPORTED vs OBSERVED BEHAVIOR

From my personal experience, once a game goes into BETA and is ready for mass player testing, market research should be evaluated ALONGSIDE Analytics, or observed player behavior.

During Beta, or even post-launch, you can always use a combination of reported behavior (survey and poll) and observed behavior (game analytics, sales) data, etc.

IV. LAUNCH & V. LIVE Service. Community-Sourced Feature Updates

One game that I personally admire A LOT is RuneScape. It isn’t everyday that a game company survives the rollercoaster ride that is the video game industry.

Not only that. Jagex has seen its game not only survive, but kicking and thriving after nearly two decades in the market. Consider this for context. When Jagex was founded in April 2000, Bill Clinton was the President of the United States, N’Sync was topping the music charts, and The Sims was a top-selling game on the PC.

The Jagex team talks a lot about “Home of the Living Game.” My interpretation? When you set your mind to making video games – and God forbid, choose to launch it as a Live-Service, you’re making a commitment. That applies, however you monetize. Premium one-time purchase? With a series of purchasable digital downloadable content? Subscription, or otherwise…

To your legacy Lapsed players, current Active players, and future soon-to-be-acquired players, you make a commitment. A commitment to maintain your game, ensure stable service, provide player support, schedule regular feature updates, add new content, launch new events, and more.

For Live Services games, ask your player community to prioritize future features, events, content? What will they pay for? What will they tell friends and family about?

But how do you do that exactly? Given the video game marketing professional that I am, you know my answer. Ask them. Something as simple as a forced rank can help you prioritize the types of content and features your players LOVE the most.

Literally let your players tell you. Which feature developments do you prioritize? Which types of events will excite them the MOST. Say, between a battle royale-style contest… and a “show the love” fan vote between their favorite K-Pop group, etc. Get specific. Ask them directly, which types of content they are MOST LIKELY to Tell Friends and Family about.

Depending on the target demographics of your game, the feedback will be different. From I can observe, some of the most successful long-standing live-services games (Supercell, King, Rovio, etc) does this exceptionally well.

That begs the question. Ask and you shall receive. What will you test next? What kinds of video game market research projects will YOU undertake, to give your game the rocket booster it needs? How can I help?